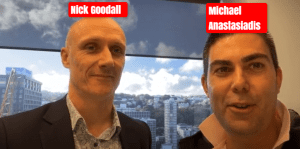

5 Minutes with Nick Goodall, Head of Research at CoreLogic NZ

(video link above, transcription below)

Michael Anastasiadis:

Okay. Good afternoon, everybody. It’s Michael Anastasiadis here, mortgage advisor from Bozinoff Mortgages, mortgages made easy, and I’m here with… Look, a familiar face, Nick Goodall.

Nick Goodall:

Hey.

Michael Anastasiadis:

The head of research from CoreLogic. Nick, say hi to everyone.

Nick Goodall:

G’day everyone. Yeah, nice to be on the famous live video.

Michael Anastasiadis:

Thanks for your time. So, look, we’ve just been at a ASB presentation here today, and Nick’s been one of the guest speakers today, and I just thought I’d grab Nick and just ask him the two questions I keep getting asked. Number one, are house prices going to drop?

Nick Goodall:

Yeah, no. Our expectation is not for prices to drop at all. And even if you look at the official forecast now, they are forecasting a sharp drop in the rate of growth. And even then that drop is probably a little bit faster than we expect. We’re sort of talking about the rate of growth maybe moving to 0% on a quarterly basis within the next year, but there’ll still be some growth in the market to come. The momentum’s quite strong and there still seems to be a fair amount of demand keeping those prices up for now.

Michael Anastasiadis:

Okay. So, let’s put that in plain language speak. If I’ve bought a house in Wellington for a million bucks, that’s going… This time next year, it’ll still be worth around a million.

Nick Goodall:

Well, at the least, we still think there’s going to be some growth in the market.

Michael Anastasiadis:

Some growth. So, did you hear that? Some growth. So, don’t panic if you’re worried that you’re going to lose value on your property.

Michael Anastasiadis:

What’s the longer-term forecast? What’s that telling you when you look out? When you extrapolate it out? Because I think on average, the Kiwi moves, I think, every seven to eight years.

Nick Goodall:

That’s right, yeah. Yeah, I think that the expectations still for long-term for the property market to hold up. The long-term appeal of holding property has not changed. Yes, some of the regulations are going to restrict some people in the amount they can borrow to buy a property. But for those that own, we don’t see anything on the horizon, outside of some crazy external shock, that would force people to sell. And that’s what’s generally going to happen to see prices drop. So, longer term, we’re still expecting those prices to hold firm.

Michael Anastasiadis:

Great answer. So, there you are. You’ve heard it from the horse’s mouth.

Michael Anastasiadis:

Question number two, I get asked all the time is, when are interest rates going to start going up? Because people are worried that these eye-candy rates of 2.25, they’re short term, they’re worried, A, that’s going to go up and all of a sudden it’ll be 7% again. What’s your take on that?

Nick Goodall:

Yeah, no, I mean, there’s official, there’s unofficial forecasts out there. Yes, the next expectation for the official cash rate, which obviously dictates those rates very significantly is for the OCR to start to lift at the end of next year at the earliest. And I think even then, some people say even that’s unlikely. We were chatting before, and Australia, they’ve essentially guaranteed no lift in their OCR for three or four years.

Michael Anastasiadis:

Correct.

Nick Goodall:

We were almost like that previously, but we have started to shift and see that come forward a little bit. And even then, when we do see the OCR start to lift, it’s going to be very gradual and only sort of push towards that 1.75% mark, as opposed to lifting to anything like we’ve seen in the past around that five or six. Of course, we need to caveat. You never know what external factors, but of course, that’s the sort of most of the expectation right now.

Nick Goodall:

I think that you need to know that the economy still needs some stimulation as well. So, even when the Reserve Bank say they might be lifting and be the first country in the world to start to release or putting less support for the market out there, even then they’re saying maybe it’s too soon there as well. So, our economy’s functioning well, much better than anyone thought, but we’re not out of the woods just yet either. So, that stimulatory effect is still likely to stick around for a bit.

Michael Anastasiadis:

Now, I’ve got one more question, but what question do you get asked the most?

Nick Goodall:

I think the first one, and what we spoke about today in the session was what impact have we seen from the changes that were announced by the Government on March 23? I think the key answer to that one is we’ve seen a pullback in demand from some areas, but there’s been so much pent-up demand. That’s meant that there hasn’t been too much of a drop away, both in those expectations or that competition for property. So, we are still seeing that growth in the market, even if it’s not quite as strong as we saw in the last six or nine months. And that’s across the board, across the country, not just here in Wellington.

Michael Anastasiadis:

So, you’re on LinkedIn. I follow you on LinkedIn. Nick Goodall there. Where else are you, Nick? Where else can people find you?

Nick Goodall:

Available on Twitter as well. NickGoodall_CL. And of course, we’ve got a podcast that we record every single Monday morning. That’s out every Monday afternoon. The New Zealand property market podcast, with Calvin, our economist, and I just to have a chat about the latest data that’s come out and what it might mean for the market. So, yeah, if you want to keep on top of things and you’re a podcast listener like me, when you’re running or whatever you’re doing or on the commute, then please do go and check that out.

Michael Anastasiadis:

Definitely listen to this guy, guys. He has a lot of real-time data and practical advice. Now, last time I saw you, Nick, we were at the Basin Reserve. And who did we see get his maiden Test century?

Nick Goodall:

Devon Conway, just last night, indeed.

Michael Anastasiadis:

Just last night. So, I’m going to have to diary-

Nick Goodall:

Get bags under the eyes.

Michael Anastasiadis:

Yeah, jeez. So, we’re going to have to diary to catch-up in two weeks’ time for another Test century.

Nick Goodall:

Indeed.

Michael Anastasiadis:

We’re calling it now.

Nick Goodall:

Huge call.

Michael Anastasiadis:

Huge call. There you are. So, there we are. I’m going to let Nick go back. Thanks, Nick. Really appreciate that.

Nick Goodall:

Brilliant, pleasure.

Michael Anastasiadis:

And I’m going to pan this camera around so people can see these awesome views. Look at that. It’s not often you’re up here this high, are you, Nick?

Nick Goodall:

No, no. Indeed. Level 20 here.

Michael Anastasiadis:

Yeah, level 20. All right, guys. We’re going to sign off. And before I do, if you found this useful, press that like button, press that share button, because the more people that see this content in these times of uncertainty, the best that is for all of us. So, God bless you all, like that content, and we’ll be in touch soon. Cheers, guys.

Nick Goodall:

Toodle-oo.

I’d love to talk to you about your finance and mortgage needs!

Learn more here: https://www.michaelmortgageman.co.nz/blog/

More about the benefits of using a Mortgage Broker here:

https://www.michaelmortgageman.co.nz/why-should-you-use-a-mortgage-broker/

Contact me here: https://www.michaelmortgageman.co.nz/#contact

Michael Anastasiadis – Mortgage Broker Wellington | Mortgage Broker NZ

#mortgagebroker #mortgagebrokerwellington #mortgagebrokernz #mortgageadvisor